The Hidden Cost of Late Payments for UK Freelancers (And How to Fix It)

2025-07-22

The real cost of waiting for payment goes far beyond delayed cash flow

Every freelancer knows this scenario: you've completed excellent work, sent a professional invoice with clear payment terms, and now you're waiting. And waiting. What started as a standard 21-day payment term has stretched into weeks, then months.

But here's what most freelancers don't calculate - the delay itself isn't the biggest problem. It's everything that happens while you're waiting.

The Hidden Costs You're Not Calculating

When we think about late payments, we focus on the obvious impact: "I need that money to pay my bills." But there are costs beneath the surface that compound over time.

The Time Cost

Every overdue invoice requires follow-up work that you're not billing for:

- Writing professional reminder emails

- Making phone calls to accounts payable departments

- Checking your bank account daily for payment updates

- Researching client company structures to find the right contact

- Administrative time tracking payment status

Conservative estimate: 2-3 hours per overdue invoice in unbillable time. At your normal hourly rate, that's significant money you're losing to administrative work instead of earning from client delivery.

The Opportunity Cost

While you're managing payment delays, you're not:

- Prospecting for new clients who pay promptly

- Developing skills that command higher rates

- Taking time off to recharge and avoid burnout

- Working on higher-value projects that excite you

- Building long-term business relationships

The compound effect: Late payments don't just delay income - they prevent business growth by consuming time that should be invested in your future.

The Mental Health Cost

Payment anxiety affects every aspect of your freelance business:

- Sleep disruption leading to reduced work quality

- Stress that impacts client relationship management

- Reduced confidence in pricing and business decisions

- Inability to plan ahead when income is unpredictable

- Relationship strain when personal finances become uncertain

The psychological toll of uncertain income creates a negative cycle that affects your ability to do your best work.

The Cash Flow Cascade Effect

Late payments create a domino effect throughout your business and personal finances:

Immediate Financial Pressure

- Using personal credit cards for business expenses

- Delaying equipment purchases that could improve your work

- Missing early payment discounts from your own suppliers

- Taking on rush jobs at lower rates to cover immediate expenses

- Borrowing money at interest to cover basic living costs

Long-term Business Impact

- Reluctance to invest in marketing when cash flow is uncertain

- Inability to take on larger projects requiring upfront costs

- Forced to accept lower-paying work instead of holding out for better clients

- Can't hire help when workload increases beyond your capacity

- Missing opportunities that require quick financial decisions

Your Legal Rights as a UK Freelancer

Under the Late Payment of Commercial Debts (Interest and Compensation) Act 2002, you have specific rights when clients pay late:

Statutory Interest: You can charge the Bank of England base rate plus 8% annually on overdue amounts. As of 2025, this means significant interest charges on late payments.

Compensation: You're entitled to fixed compensation for debt recovery costs:

- £40 for debts under £1,000

- £70 for debts £1,000-£10,000

- £100 for debts over £10,000

Legal Leverage: Simply mentioning these rights in payment terms often encourages prompt payment, as many clients aren't aware you have this protection.

Prevention Strategies That Actually Work

The best payment problems are the ones that never happen:

Set Clear Expectations Upfront

- Include specific payment terms in contracts, not just invoices

- Require deposits for new clients or large projects

- Use milestone payments for longer engagements

- Specify exactly which payment methods you accept

- Include your late payment policy in initial client communications

Make Payment Stupidly Easy

- Provide multiple payment options (bank transfer, online payment, etc.)

- Include all necessary payment details clearly on every invoice

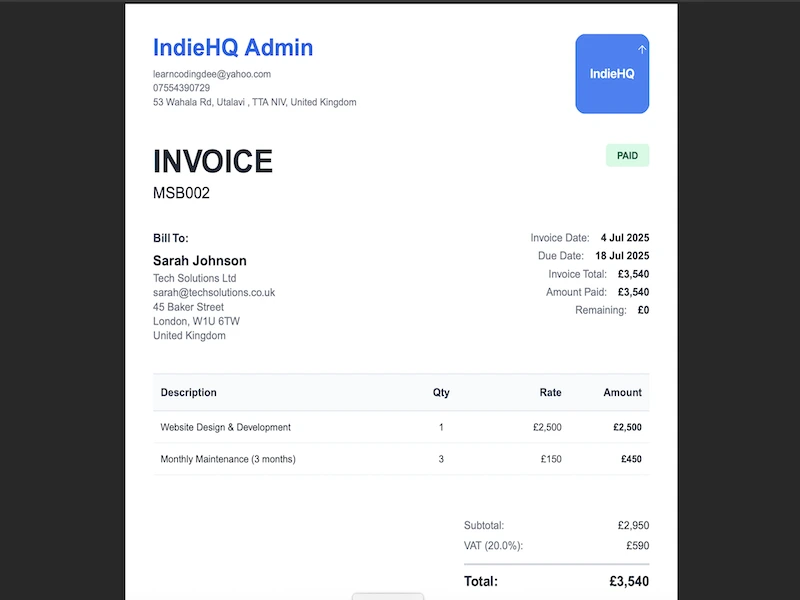

- Use professional invoice design that builds trust and credibility

- Send invoices immediately upon project completion

- Follow up within 24 hours to confirm invoice receipt

Professional invoice design reduces payment delays and builds client confidence

Professional invoice design reduces payment delays and builds client confidence

Build Professional Follow-Up Systems

The key to effective payment collection is consistency and professionalism:

7 days overdue: Friendly check-in assuming good faith

14 days overdue: Professional follow-up with fresh invoice copy

21+ days overdue: Final notice mentioning next steps and legal rights

The critical factor is removing emotion from the process. Professional systems handle reminders automatically, so you stay focused on client work instead of payment anxiety.

Technology That Removes the Emotional Labor

Modern invoice management eliminates the stress of manual payment tracking:

Automatic overdue detection - Know immediately when payments are late Professional reminder templates - Consistent, courteous follow-up language Payment status tracking - Clear visibility across all outstanding invoices Client communication logs - History of all payment-related correspondence Cash flow forecasting - Predict income based on outstanding invoices

![]() Track payment status without emotional investment in each individual case

Track payment status without emotional investment in each individual case

The psychological benefit is enormous: instead of worrying "should I chase this payment?", professional systems handle follow-ups while you focus on delivering excellent work.

The Compound Benefits of Getting This Right

When you implement professional payment systems, positive changes cascade through your entire business:

Immediate: Stress reduction from automated processes

Week 2-4: Noticeable improvement in average payment times

Month 2-3: Predictable cash flow enables better business planning

Month 6: Increased confidence allows selective client acceptance

Year 1: Strong business foundation supports sustainable growth and higher rates

Common Mistakes That Make Everything Worse

Avoid these payment collection errors:

- Waiting too long before first follow-up (start at 7 days, not 30)

- Using aggressive or threatening language in reminders

- Taking payment delays personally instead of treating them as business process

- Inconsistent follow-up that confuses clients about your professionalism

- Continuing work on new projects when previous invoices remain unpaid

Professional approach instead:

- Consistent, courteous communication at regular intervals

- Clear consequences explained calmly and professionally

- Separation of payment issues from ongoing project work

- Documentation of all payment-related communications

- Escalation procedures that maintain business relationships

Building Your Payment Protection System

Start implementing these changes this week:

Today: Review your current contract language and add clear payment terms This week: Create professional invoice templates with all necessary payment information Next week: Set up systematic reminder processes for overdue payments This month: Implement client communication systems that prevent problems before they start

The goal isn't to become aggressive about payments - it's to create professional systems that protect your time and mental energy while maintaining positive client relationships.

Taking Control of Your Cash Flow

Late payments are a business challenge with proven business solutions. Freelancers who get paid consistently aren't lucky - they're systematic about protecting their income.

Professional payment management isn't about being pushy with clients. It's about respecting your own business enough to run it with the same professionalism you bring to client work.

Your expertise deserves prompt payment. Professional systems ensure you get it.

Ready to take control of your payment process? IndieHQ helps UK freelancers implement professional invoice management and systematic payment collection. See how organized systems can transform your cash flow at indiehq.org.